- Dividend Data

- Posts

- Warren Buffett's New Annual Letter + Dividend Raises + My New Buy

Warren Buffett's New Annual Letter + Dividend Raises + My New Buy

Hey, Zach here! Happy Monday…

We ended last week with a big sell off. I used that as an opportunity to buy a quality big tech stock. Today, I’m going to discuss some important updates to get you ready for another week of successful investing.

Today’s topics:

19 New Dividend Increases

My Latest Stock Analysis Video

Warren Buffett’s New Annual Letter

My Latest Stock Buy

Let’s do this!

Dividend Increases

19 Dividend Raises From This Week!

Dividends won’t stop growing! This week, we got increases from legends like Coca-Cola and newer dividend growth stocks like Texas Roadhouse.

$WM - Waste Management declares $0.825/per share, a 10% increase from the prior dividend of $0.750.

$KO - The Coca-Cola Company today approved the company’s 63rd consecutive annual dividend increase, raising the quarterly dividend approximately 5.2% from $0.485 to $0.51 per common share.

$TXRH - Texas Roadhouse declares $0.68/share quarterly dividend, 11.5% increase from prior dividend of $0.61.

$ADI - Analog Devices declares $0.99/share quarterly dividend, 7.6% increase from prior dividend of $0.92.

$AGO - Assured Guaranty declares $0.34/share quarterly dividend, 9.7% increase from prior dividend of $0.31.

$MTDR - Matador Resources declares $0.3125/share quarterly dividend, 25% increase from prior dividend of $0.2500.

$GPC - Genuine Parts declares $1.03/share quarterly dividend, 3% increase from prior dividend of $1.00.

$GIL - Gildan Activewear declares $0.226/share quarterly dividend, 10.2% increase from prior dividend of $0.205.

$DVN - Devon Energy declares $0.24/share quarterly dividend, 9.1% increase from prior dividend of $0.22.

$OXY - Occidental Petroleum declared $0.24/share quarterly dividend, 9.1% increase from prior dividend of $0.22.

$SHW - Sherwin Williams declares $0.79/share quarterly dividend, 10.5% increase from prior dividend of $0.71.

$O - Realty Income declared $0.268/share monthly dividend, 1.5% increase from prior dividend of $0.264.

$JXN - Jackson Financial declared $0.80/share quarterly dividend, 14.3% increase from prior dividend of $0.70.

$TMO - Thermo Fisher Scientific declares $0.43/share quarterly dividend, 10% increase from prior dividend of $0.39.

$ALSN - Allison Transmission Holdings declares $0.27/share quarterly dividend, 8% increase from prior dividend of $0.25.

$OLED - Universal Display declares $0.45/share quarterly dividend, 12.5% increase from prior dividend of $0.40.

$FIX - Comfort Systems declares $0.40/share quarterly dividend, 14.3% increase from prior dividend of $0.35.

$DHR - Danaher declared $0.32/share quarterly dividend, 18.5% increase from prior dividend of $0.27.

$DD - DuPont declares $0.41/share quarterly dividend, 7.9% increase from prior dividend of $0.38.

Become a DividendData.com member and get dividend news, filtered by the stocks in your watchlist and portfolio.

Or, view our dividend news feed for Free.

This Email is Brought To You By…

Discover a generational opportunity to invest in Alaska's energy riches.

Klondike Royalties offers access to an estimated 300 million barrels of recoverable oil reserves in the Cook Inlet. Our royalty structure is designed to provide potential for steady returns.

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at invest.klondikeroyalties.com.

My Analysis

Top 10 Dividend Increases You Can’t Afford to Miss

I just dropped a new video covering the latest dividend increases, and I wanted to share the first 3 stocks discussed here:

Coca-Cola (KO):

Celebrated its 63rd consecutive dividend increase with a 5.2% raise to 51¢ per share.

Now pays an annual dividend of $2.04, yielding about 2.91%.

A true dividend king with steady growth (5-year CAGR of 4.46%)

Meta Platforms (META):

Announced its first-ever dividend increase—a 5% boost to 0.525 per share.

Although the yield is low at 0.3%, the company’s robust earnings and free cash flow make it a compelling growth play.

Demonstrates impressive revenue and cash flow expansion, setting the stage for future dividend growth.

Realty Income (O):

Recently raised its monthly dividend by 1.5%, with a forward annual dividend of $3.22.

Currently yields about 5.69%, supported by a steady 5-year dividend CAGR of 3.49%.

A solid dividend stock, with a recent price pullback that might offer a great entry point.

To get my full analysis on all 10 stocks with great data visualizations, watch my video linked here.

Investing Legend

Warren Buffett Just Released His New Annual Letter For Berkshire Hathaway

A tradition for investors is reading the latest thoughts from Warren Buffett, one of the best investors of all time.

These letters are witty and packed with wisdom. If you haven’t read them, I suggest you go check out the archive. It will make you a smarter investor.

Why it Matters…

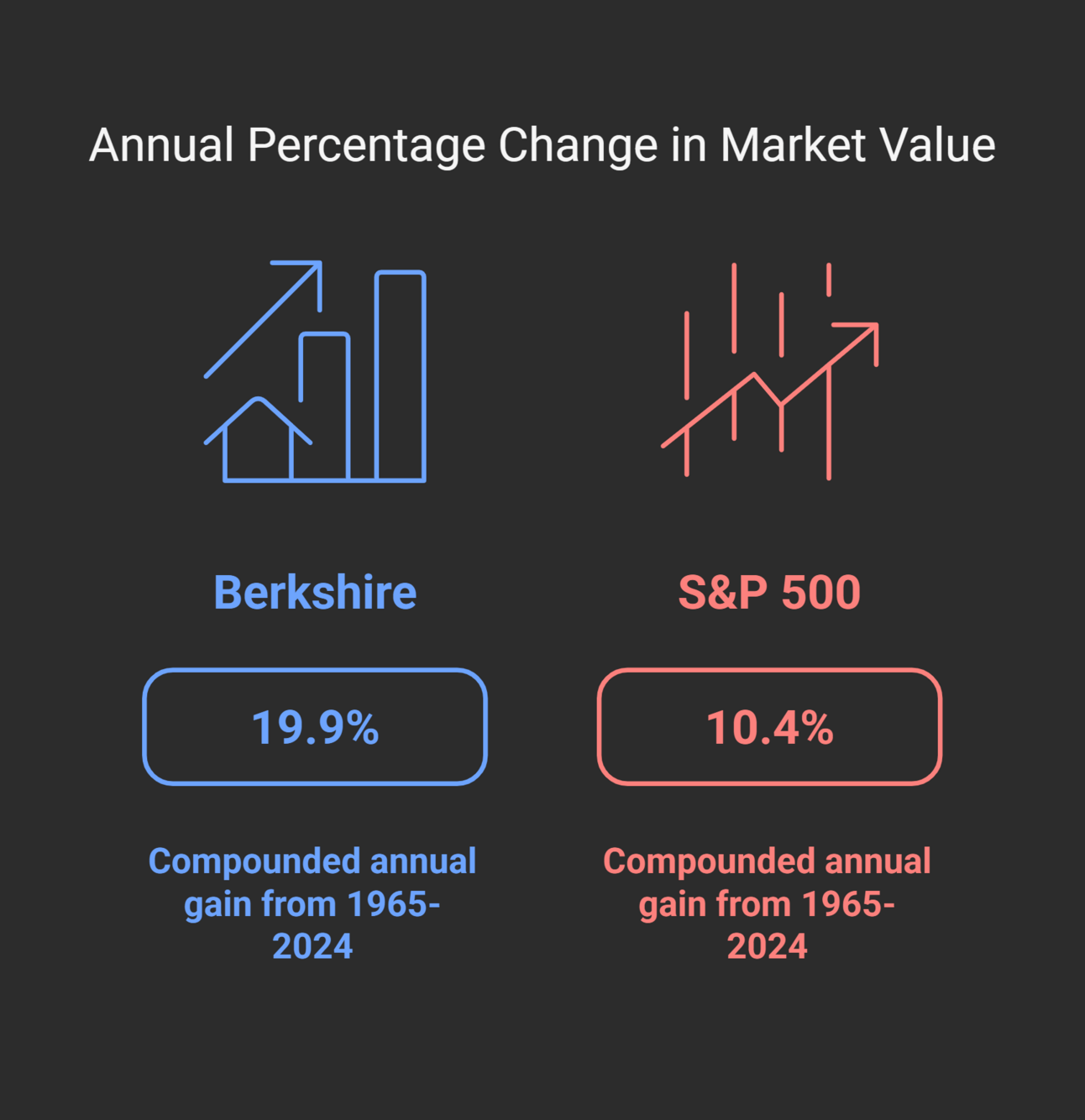

Berkshire Hathaway Has Crushed the S&P 500!

Compounded Annual Gain (1965-2024), 19.9% vs 10.4%

Overall Gain (1964-2024), 5,502,284% vs 39,054%

Fun Fact

This was a crazy stat, Buffett provided in the annual letter.

“To be precise, Berkshire last year made four payments to the IRS that totaled $26.8 billion. That’s about 5% of what all of corporate America paid.”

New Buy

I Bought More Alphabet (GOOGL)

Bought 2 shares of $GOOGL at $181.66

— Dividend Data (@dividend_data)

6:03 PM • Feb 21, 2025

How did you like today’s newsletter? |

Thanks for the read! Let me know what you thought by replying back to this email.

— Zach

Disclaimer: Dividend Dividend (Dividend Data LLC) is not a professional financial service. All materials released from Dividend Data (Dividend Data LLC) are for educational and entertainment purposes. Dividend Data (Dividend Data LLC) is not a replacement for a professional's opinion. Contributors to the Dividend Data (Dividend Data LLC) might have equities mentioned in the newsletter