- Dividend Data

- Posts

- The Market is Wrong About Microsoft Stock

The Market is Wrong About Microsoft Stock

Happy Monday,

It’s Zach here from Dividend Data.

Microsoft (MSFT) fell about 6% year-to-date and roughly 17.5% from its all-time high. The sentiment is bearish. Investors are worried about the "death of software".

Here is why the market is wrong about Microsoft.

Topics Covered:

Microsoft Stock Analysis

Pro Tip: Build Your Cash Position!

Earnings Season is Back!

Dividend News This Week

What I Bought This Week

The Key Story

Why I’m Buying Microsoft Stock

1. The "Death of Software" is Exaggerated

The bear case is that seat growth is slowing. It’s true—seat growth has dropped from +20% Y/Y during the pandemic to about +6% Y/Y today.

However, the Microsoft 365 bundle (Word, Excel, Teams) is sticky. Despite slower seat growth, revenue in this segment is still growing 15% year-over-year. AI "Copilots" and “Agents“ are being integrated into this bundle, which will likely increase monetization, not kill it.

2. The Real Engine: The Intelligent Cloud

The biggest reason I am buying is Azure.

While the software side gets the headlines and is how most normies know Microsoft, the cloud business is the real growth engine.

Accelerating Growth: Azure revenue growth has re-accelerated to 39% year-over-year.

Massive Demand: They are doubling their data center footprint over the next two years to meet AI demand.

Future Revenue: Remaining performance obligations (booked future revenue) have exploded to $398 billion.

We are in the early innings of a massive data center buildout, and Microsoft owns the full stack—from the code repository (GitHub) to the hosting (Azure).

3. A Cash Cow at a Fair Price

Despite spending massive amounts on new data centers, Microsoft is a cash machine.

Free Cash Flow: They generated $26 billion in free cash flow in the latest quarter alone.

Balance Sheet: They have NEGATIVE net debt of $41 billion.

Valuation: The stock trades at a forward P/E of roughly 27. Given their double-digit growth estimates, I believe this is a fair price for one of the highest-quality companies in the world.

Conclusion

I believe Microsoft has a secure path to capturing a large section of the AI market. It is a core position in my portfolio, and I added more shares during this week's dip.

If you want to dive deeper, check out my full breakdown on YouTube.

Pro Tip

Save Money! Build Your Cash Position

Smart investors call this "dry powder". It puts you in a position of strength when the market presents opportunities.

But, leaving that money in a regular savings or checking account is a mistake. It earns basically nothing while it sits there.

You should view a High-Yield Savings Account (HYSA) as the perfect holding tank. It allows your cash to earn a "dividend" (interest) while it waits for a stock to hit your buy price.

Bankrate aggregates the top rates in real-time, so you can compare them side-by-side. It is an easy win for your financial bottom line.

Make sure your cash works as hard as your stocks.

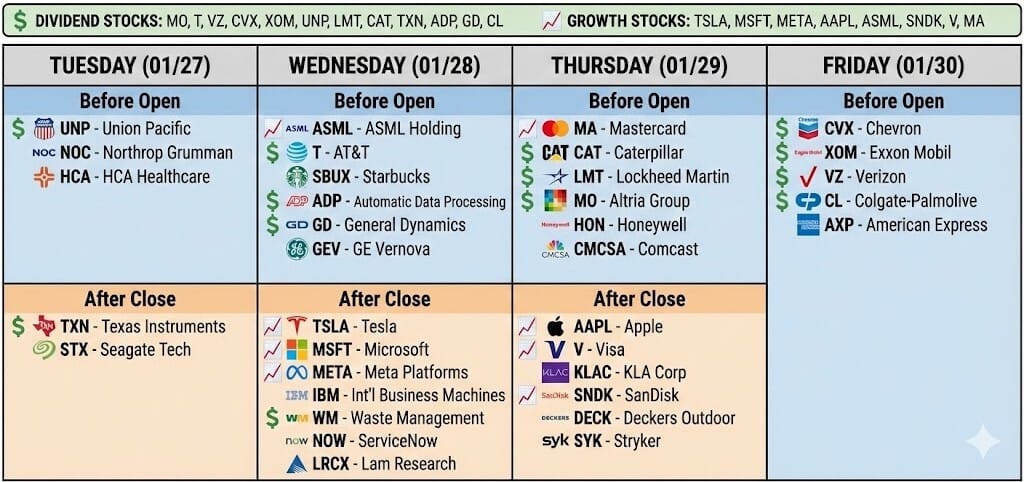

Earnings This Week

Microsoft, Tesla, Altria, Visa, ExxonMobil, etc

Top Dividend Stocks: Altria (MO), AT&T (T), Verizon (VZ), Chevron (CVX), Exxon Mobil (XOM), Union Pacific (UNP), Lockheed Martin (LMT), Caterpillar (CAT), Texas Instruments (TXN), ADP, General Dynamics (GD), Colgate-Palmolive (CL), etc.

Top Growth Stocks: Tesla (TSLA), Microsoft (MSFT), Meta (META), Apple (AAPL), ASML, SanDisk (SNDK), Visa (V), Mastercard (MA), etc.

Here’s the full list to watch:

Tuesday (01/27):

UNP - Union Pacific Corporation

NOC - Northrop Grumman Corporation

HCA - HCA Healthcare Inc.

TXN - Texas Instruments Incorporated

STX - Seagate Technology Holdings PLC

Wednesday (01/28):

ASML - ASML Holding NV

T - AT&T Inc.

SBUX - Starbucks Corporation

ADP - Automatic Data Processing, Inc.

GD - General Dynamics Corporation

GEV - GE Vernova Inc.

TSLA - Tesla Inc.

MSFT - Microsoft Corporation

META - Meta Platforms, Inc.

IBM - International Business Machines

WM - Waste Management, Inc.

NOW - ServiceNow, Inc.

LRCX - Lam Research Corporation

Thursday (01/29):

MA - Mastercard Incorporated

CAT - Caterpillar Inc.

LMT - Lockheed Martin Corporation

MO - Altria Group, Inc.

HON - Honeywell International Inc.

CMCSA - Comcast Corporation

AAPL - Apple Inc.

V - Visa Inc.

KLAC - KLA Corporation

SNDK - SanDisk Corporation

DECK - Deckers Outdoor Corp

SYK - Stryker Corporation

Friday (01/30):

CVX - Chevron Corporation

XOM - Exxon Mobil Corporation

VZ - Verizon Communications Inc.

CL - Colgate-Palmolive Company

AXP - American Express Company

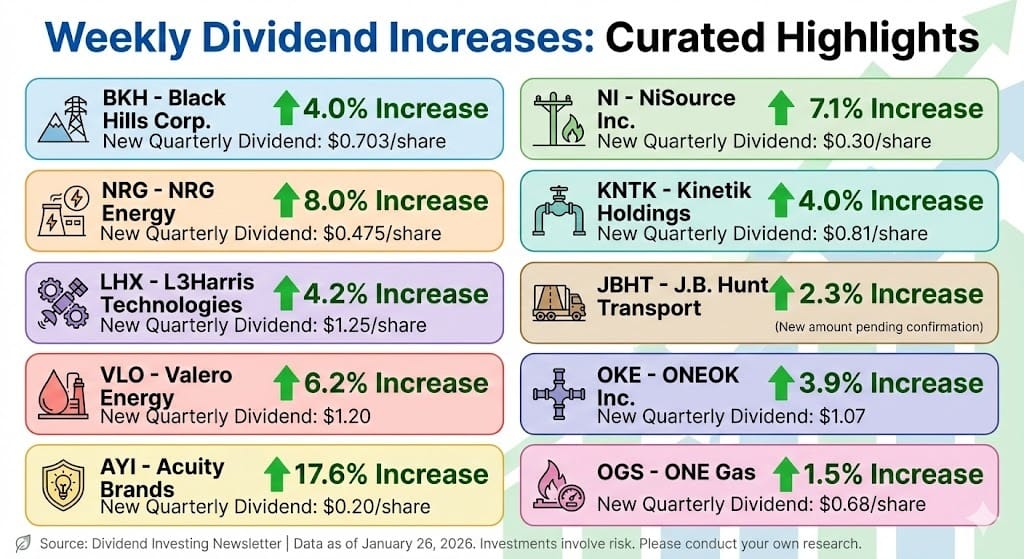

Dividend News

🚀 Dividend Raises This Month

OKE - ONEOK raises dividend by 3.9% to $1.07

OGS - ONE Gas raises dividend by 1.5% to $0.68

BKH - Black Hills raises quarterly dividend by 4% to $0.703/share

NRG - NRG Energy raises quarterly dividend by 8% to $0.475/share

LHX - L3Harris Technologies raises quarterly dividend by 4.2% to $1.25/share

VLO - Valero Energy raises dividend by 6.2% to $1.20

AYI - Acuity raises quarterly dividend by 17.6% to $0.20/share

NI - NiSource raises quarterly dividend by 7.1% to $0.30/share

KNTK - Kinetik raises quarterly dividend by 4% to $0.81/share

JBHT - J.B. Hunt Transport Services raises dividend by 2.3%

My Buys

What I Bought This Week

Microsoft, of course…

10 shares of Microsoft (MSFT) at an average cost per share of $440.61

How did you like today’s newsletter? |

That’s it for this week’s update. If you want to follow along in real time, analyze these tickers, or track your own portfolio, jump into DividendData.com. You’ll also find our Discord community and my AI research tool there. Hit reply and tell me what you’re buying—I may feature a few notes next week.

📅 Keep Investing. Stay informed.

– Zach

Founder, Dividend Data

P.S. Questions or suggestions? Reply to this email—I'd love your feedback!

Follow on YouTube | Listen on Spotify | Visit DividendData.com

Disclaimer: Dividend Dividend (Dividend Data LLC) is not a professional financial service. All materials released from Dividend Data (Dividend Data LLC) are for educational and entertainment purposes. Dividend Data (Dividend Data LLC) is not a replacement for a professional's opinion. Contributors to the Dividend Data (Dividend Data LLC) might have equities mentioned in the newsletter