- Dividend Data

- Posts

- I Just Bought $46,000 of Microsoft Stock.

I Just Bought $46,000 of Microsoft Stock.

Happy Monday,

It's Zach here from Dividend Data.

This week I made my biggest move of 2026 — a $46,000 bet on Microsoft.

I completely sold out of Visa (a stock I've held for years) and went

all-in on MSFT.

Here's why, plus what's on the earnings calendar this week.

Topics Covered:

• Why I Bought $46,000 of Microsoft Stock

• Early Access Sale: Spreadsheet Tools (Lock In Your Price!)

• Massive Earnings Week: Google, Amazon, AMD & More

• Dividend Raises This Week

The Key Story

I Just Bought $46,000 of Microsoft Stock.

I completely sold out of my position in Visa — a company I've held for

many years. I took all of that capital combined with a lot of new cash

and dropped over $46,000 into Microsoft stock after the earnings

crash.

WHY I MADE THIS MOVE

It's not because Visa is a bad company. Visa is an incredible business

— extremely high margin, scalable. My logic entirely has to do with

Microsoft.

In my opinion, Microsoft is an even better business trading at a more

attractive price with higher growth prospects.

WHY MICROSOFT? WHY NOW?

The Market is Getting Microsoft Wrong

Over the past few months, investors have been getting more bearish on

Microsoft. They think it's getting riskier — I actually think it's

getting de-risked.Historically Cheap Valuation

Forward P/E ratio around 25. This is historically one of the lowest

P/E ratios for Microsoft. Nearly trading as cheap as the fall 2022

sell-off.Azure Cloud is Accelerating

Growing 38% year-over-year in constant currency. On the earnings call,

they said this was conservative — they could push into mid-40% growth.The Capex Spend is an Investment, Not a Gamble

$29.8 billion in capex last quarter. I view it as intelligent

investment into infrastructure they're monetizing very well.Remaining Performance Obligations (RPOs) Exploding

Booked future revenue jumped from $400B to $631B.Fantastic Balance Sheet

$390 billion in shareholder equity. Just under $100B in cash & short term investments. Negative net debt. Record free cash flow while investing heavily.

Watch full breakdown → https://www.youtube.com/watch?v=wK8riGKuUOE

Early Access Sale

🚀 Be First to Access Our New Spreadsheet Tools

Big news: Our Excel add-in just got submitted for approval.

We're in the final stages of launching Dividend Data for Spreadsheets

— bringing all of our stock research data directly into Google Sheets

and Microsoft Excel.

WHAT YOU GET:

• 30+ years of fundamental data at your fingertips

• Custom formulas for dividend yields, payout ratios, growth rates

• Build your own screeners and trackers

• No more copy-pasting — it's all live

If you join during early access, you lock in the best price we're ever

going to offer. After the official launch, prices go up for new

members.

Get 50% Off — Early Access Sale → https://dividenddata.beehiiv.com/upgrade

Don't wait — once Excel goes live, the sale ends.

Earnings This Week

Google, Amazon, HESM, PepsiCo, PLTR, PM, etc.

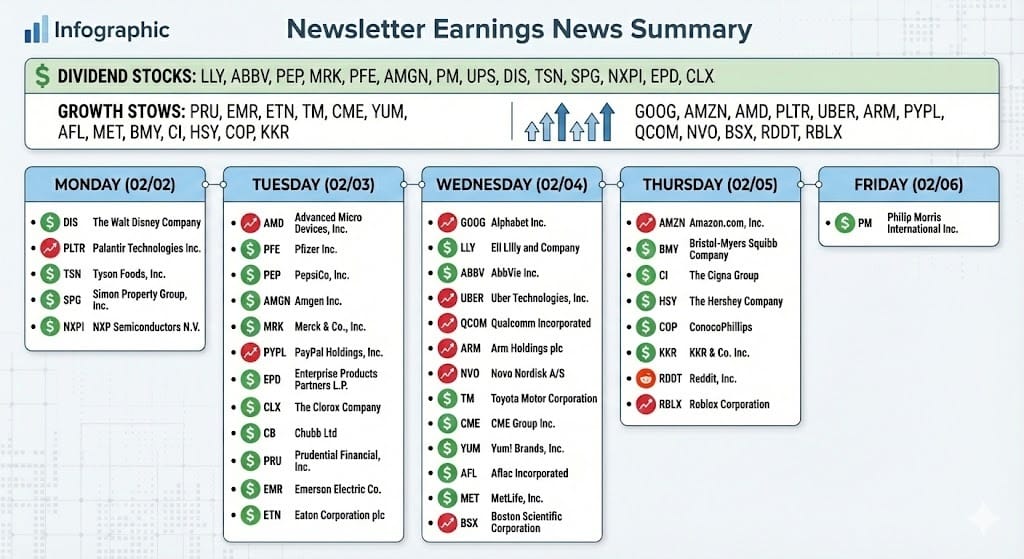

Top Dividend Stocks: LLY, ABBV, PEP, MRK, PFE, AMGN, PM, UPS, etc. Top Growth Stocks: GOOG, AMZN, AMD, PLTR, UBER, ARM, etc.

Here’s the full list to watch:

Monday (02/02):

DIS - The Walt Disney Company

PLTR - Palantir Technologies Inc.

HESM - Hess Midstream

TSN - Tyson Foods, Inc.

SPG - Simon Property Group, Inc.

NXPI - NXP Semiconductors N.V.

Tuesday (02/03):

AMD - Advanced Micro Devices, Inc.

PFE - Pfizer Inc.

PEP - PepsiCo, Inc.

AMGN - Amgen Inc.

MRK - Merck & Co., Inc.

PYPL - PayPal Holdings, Inc.

EPD - Enterprise Products Partners L.P.

CLX - The Clorox Company

CB - Chubb Ltd

PRU - Prudential Financial, Inc.

EMR - Emerson Electric Co.

ETN - Eaton Corporation plc

Wednesday (02/04):

GOOG - Alphabet Inc.

LLY - Eli Lilly and Company

ABBV - AbbVie Inc.

UBER - Uber Technologies, Inc.

QCOM - Qualcomm Incorporated

ARM - Arm Holdings plc

NVO - Novo Nordisk A/S

TM - Toyota Motor Corporation

CME - CME Group Inc.

YUM - Yum! Brands, Inc.

AFL - Aflac Incorporated

MET - MetLife, Inc.

BSX - Boston Scientific Corporation

Thursday (02/05):

AMZN - Amazon.com, Inc.

BMY - Bristol-Myers Squibb Company

CI - The Cigna Group

HSY - The Hershey Company

COP - ConocoPhillips

KKR - KKR & Co. Inc.

RDDT - Reddit, Inc.

RBLX - Roblox Corporation

Friday (02/06):

PM - Philip Morris International Inc.

Dividend News

🚀 Dividend Raises This Month

ET - Energy Transfer raises dividend by 0.8%

WMB - Williams raises dividend by 5% to $0.525

HESM - Hess Midstream Partners raises dividend by 1.2% to $0.7641

GM - General Motors raises dividend by 20% to $0.18

KMB - Kimberly-Clark increases quarterly dividend by ~2% to $1.28/share

CINF - Cincinnati Financial raises quarterly dividend by 8% to $0.94/share

PHIN - PHINIA raises quarterly dividend by 11.1% to $0.30/share

PII - Polaris raises quarterly dividend by 2% to $0.68/share

FIS - Fidelity National raises quarterly dividend by 10% to $0.44/share

AROC - Archrock raises quarterly dividend by 4.8% to $0.22/share

HWC - Hancock Whitney raises quarterly dividend by 11.1% to $0.50/share

J - Jacobs Engineering raises dividend by 12.5% to $0.36

LVS - Las Vegas Sands raises dividend by 20% to $0.30

OSK - Oshkosh raises dividend by 11.8% to $0.57/share

MGY - Magnolia Oil & Gas raises dividend by 10%

TTEK - Tetra Tech raises quarterly dividend by 12% to $0.065/share

UTL - Unitil raises dividend by 6% to $0.475

CWT - California Water Service raises quarterly dividend by 11.7% to $0.335/share

HXL - Hexcel raises quarterly dividend by 5.9% to $0.18/share

MUR - Murphy Oil raises quarterly dividend by 7.7% to $0.35/share

AJG - Arthur J. Gallagher raises dividend by ~8%

URI - United Rentals raises dividend by 10%

SNDR - Schneider National raises dividend by 5.3% to $0.10

HCA - HCA Healthcare raises dividend by 8.3% to $0.78

ES - Eversource Energy raises dividend by 4.7% to $0.7875

MSCI - MSCI raises dividend by 13.9% to $2.05

ELV - Elevance Health raises dividend by 0.6% to $1.72/share

APD - Air Products and Chemicals raises quarterly dividend by 1.1% to $1.81/share

SF - Stifel Financial raises quarterly dividend by 10.9% to $0.51/share

ED - Consolidated Edison raises dividend by 4.4%

SUN - Sunoco LP raises quarterly dividend by 1.2% to $0.9317/share

CR - Crane raises dividend by 10.9% to $0.255

AIT - Applied Industrial Technologies raises dividend by 10.9% to $0.51

WFRD - Weatherford International raises quarterly dividend by 10% to $0.275/share

What I Bought This Week

Dividend Growth Portfolio

89 shares of $MSFT at an average cost per share of $432.10

Roth IRA

12 shares of $MSFT at a cost per share of $426.11

How did you like today’s newsletter? |

That’s it for this week’s update. If you want to follow along in real time, analyze these tickers, or track your own portfolio, jump into DividendData.com. You’ll also find our Discord community and my AI research tool there. Hit reply and tell me what you’re buying—I may feature a few notes next week.

📅 Keep Investing. Stay informed.

– Zach

Founder, Dividend Data

P.S. Questions or suggestions? Reply to this email—I'd love your feedback!

Follow on YouTube | Listen on Spotify | Visit DividendData.com

Disclaimer: Dividend Dividend (Dividend Data LLC) is not a professional financial service. All materials released from Dividend Data (Dividend Data LLC) are for educational and entertainment purposes. Dividend Data (Dividend Data LLC) is not a replacement for a professional's opinion. Contributors to the Dividend Data (Dividend Data LLC) might have equities mentioned in the newsletter