- Dividend Data

- Posts

- I Got Paid My Biggest Dividend Ever

I Got Paid My Biggest Dividend Ever

Happy Monday! Today’s topics:

My Biggest Dividend Payer Ever

Earnings Season Is Back (Stocks This Week)

Something Fun

Let’s do this!

The Key Story

I Just Earned $559.05 in Dividends from Altria (MO)

Today’s a big day for my dividend portfolio—I received a $559.05 payout from Altria Group (ticker: MO).

Got paid $559.05 in dividends today from $MO

— Dividend Data (@dividend_data)

3:43 PM • Jan 10, 2025

I’ve been buying shares of this high-yield dividend growth stock since 2020, with most of my position built during 2022 through early 2024.

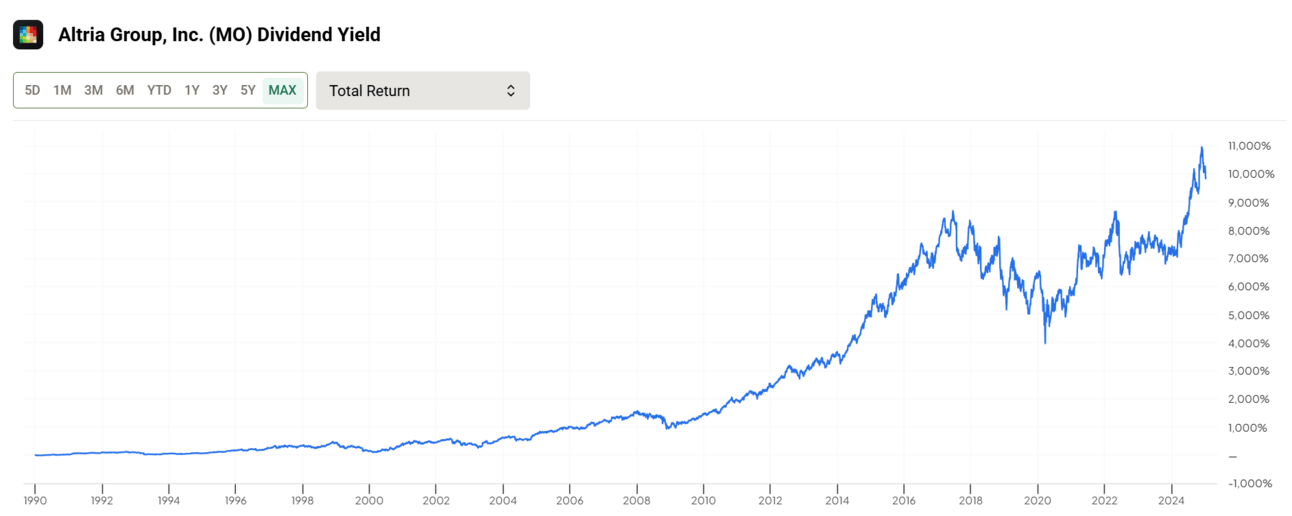

Thanks to consistent reinvestment of these dividends, my total return on Altria is now 43%—and when factoring in all those reinvested dividends, I’m effectively earning an 11.45% annual yield on my initial cost.

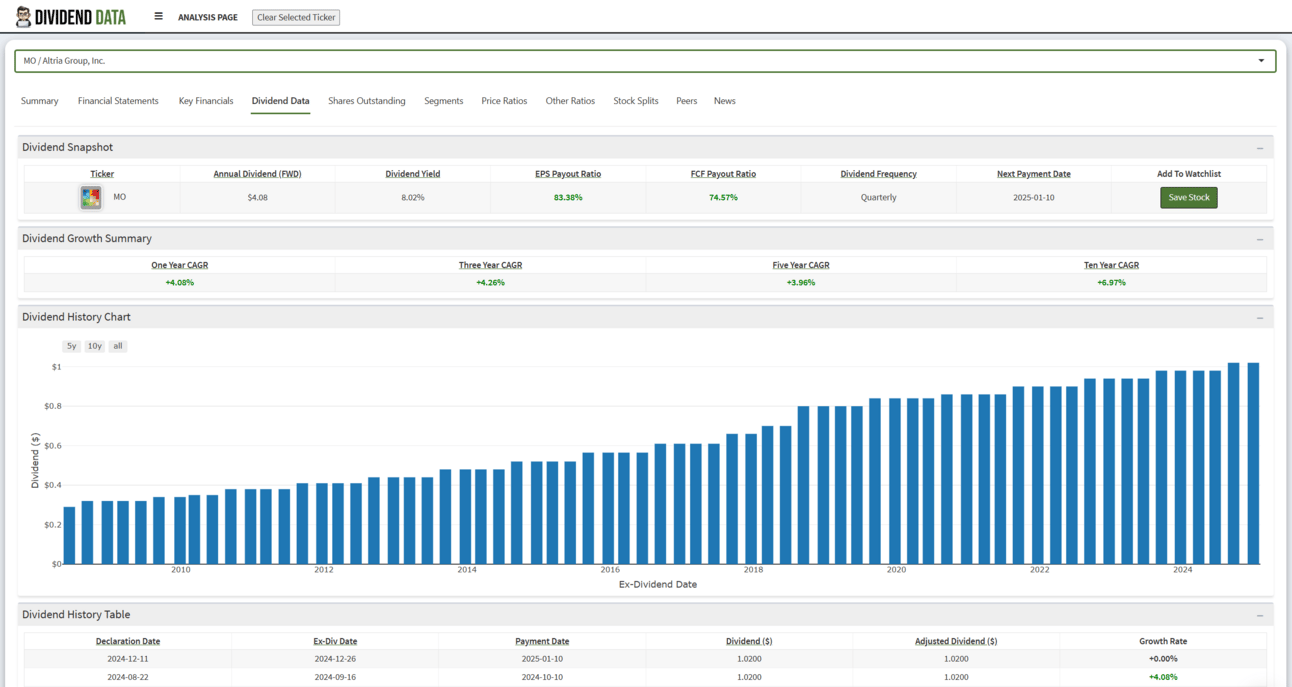

Why Altria? Despite operating in a slow-growth industry, this company has raised its dividend every single year for over half a century, officially qualifying it as a “Dividend King.” Currently, Altria yields around 7.8%, a level many income-focused investors find hard to ignore. What makes it even more appealing is its 74% free cash flow payout ratio, a figure that shows Altria can comfortably meet its dividend obligations with real cash from its core business.

Of course, buying a high-yield stock isn’t without risks. In my latest video, I touched on the dangers of simply chasing large payouts.

Many companies with inflated yields face deteriorating fundamentals or looming dividend cuts. Altria hasn’t been immune to challenges—think of the now-infamous Juul investment—but it continues generating strong cash flow and rewarding shareholders. Over the long term, that reliability has contributed to a 10,000% total return since 1990.

For me, receiving over $500 from just one stock highlights the incredible power of consistent, high-yield dividend payers. I’m reinvesting that money back into the market, fueling the “snowball effect” that should further boost my future dividend income.

If you’re seeking sustainable high yield, Altria’s a prime case study—just remember to dig into the fundamentals and avoid companies whose big payouts mask deeper problems.

This Email Was Brought To You By…

Two Dragons, 100,000 Customers, and Now ... You.

What do billion-dollar founder Brian Scudamore, Dragons' Den star Wes Hall, and 100,000 satisfied customers have in common? They all believe in Smart Nora—the breakthrough patented technology that's transforming sleep. With the global sleep market set to double to $950B by 2032, Smart Nora is opening its doors to public investors for the first time. Early investors get exclusive terms to join these business titans in backing sleep tech's next success story.

Don't sleep on this opportunity.

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at invest.smartnora.com. This is a paid advertisement for Smart Nora, LLC's Reg CF campaign.

Earnings News

Earnings Season is About To Start!

Wednesday - (1/15/2025)

$JPM - JP Morgan Chase

$GS - Goldman Sachs

$BLK - BlackRock

$C - Citigroup Inc.

$WFC - Wells Fargo

Thursday - (1/16/2025)

$TSM - Taiwan Semiconductor Manufacturing Company Limited

$UNH - UnitedHealth Group Incorporated

$BAC- Bank of America

$MS - Morgan Stanley

$USB - U.S. Bancorp

Friday - (1/17/2025)

$SLB - Schlumberger Limited

$FAST - Fastenal Company

$TFC - Truist Financial Corporation

$STT - State Street Corporation

To keep up with all the earnings this week, and moving forward, our go-to earnings source is Earnings Hub. You can join for free.

Something Fun…

My favorite NFL team, Washington Commanders, just won this week in the playoffs. The first playoff win since 2005.

We finally have a Quarterback…

Jayden Daniels stays getting hit like it’s Looney Tunes

— Barstool Sports (@barstoolsports)

1:51 AM • Jan 13, 2025

How did you like today’s newsletter? |

Thanks for the read! Let me know what you thought by replying back to this email.

— Zach

Disclaimer: Dividend Dividend (Dividend Data LLC) is not a professional financial service. All materials released from Dividend Data (Dividend Data LLC) are for educational and entertainment purposes. Dividend Data (Dividend Data LLC) is not a replacement for a professional's opinion. Contributors to the Dividend Data (Dividend Data LLC) might have equities mentioned in the newsletter