- Dividend Data

- Posts

- How I Turned $0 Into $500/Month in Dividend Income by Age 26

How I Turned $0 Into $500/Month in Dividend Income by Age 26

Hey, Zach here!

Today, I’ll share the latest update on my personal dividend growth stock portfolio. That will include my story of growing the account from $0 to a new milestone of $500/month of dividend income. On top of that, I’ll share my new buys from the week.

Today’s topics:

My Dividend Income Milestone

Dividend Increases This Week

Earnings This Week

My New Buys

Key Story

How I Turned $0 Into $500/Month in Dividend Income by Age 26

My Dividend Milestone (0:00)

New high: ~$6,014/year (≈ $500/month) in projected dividend income.

Portfolio value: $249,000 after investing $150,000 over ~5 years.

Total return: ~$100,000 (≈ 65.8%).

$18,500+ in dividends earned so far—all reinvested to accelerate the snowball.

The goal isn’t just yield—own high-quality businesses that grow earnings and dividends over time.

Major Website Update / News (3:17)

10× coverage expansion: from ~8,000 to 80,000+ tickers—now includes ETFs, mutual funds, and international stocks.

New ETF view: TTM dividends, expense ratio, NAV, AUM, holdings, sector breakdown, forward yield, and 3/5/10-yr dividend growth—plus full dividend history.

Global search bar on every page; click any ticker anywhere to jump into full analysis (e.g., LVMH now supported).

AI Analyst has suggested prompts to open tools (Stock Screener, DCF).

Pro tip: Favorite the Stock Screener for one-click access to hundreds of editable filters.

My Journey (6:30)

Started in college; grew active income, kept living costs low, and invested the difference.

Built this YouTube channel and DividendData.com to turn active income into ownership of quality dividend growers.

It’s a long-term approach—avoid “get rich quick.”

New Stock Buys Explained — $5,334 Total (9:24)

MPLX: 33 shares @ $50.54 (~$1.6k), adds $126/yr; ~7.6% yield; 10.7% 3-yr dividend CAGR; latest hike 12.5%; management guiding ~12.5% raises for next few years.

TPL: 3 shares @ $913.68 (~$2.7k), adds $19.20/yr; asset-light royalty model; ~89% gross / 64% net margins, no debt; base dividend up 36% last increase + periodic specials.

HESM: 24 shares @ $38.55 (~$1k), adds $70/yr; ~7.8% yield; quarterly raises (last +3.83%); ~11% 5-yr dividend CAGR; 1099-DIV (no K-1).

Income Projection (14:42)

Dividend growth only (no reinvestment, no new money): in 10 years dividends reach ~$11,700/yr.

Future Projection—The Snowball (15:17)

My Portfolio’s weighted dividend growth: ~8.98%.

With reinvestment and reasonable price growth assumptions:

Year 10: ~$15.8k/yr dividends; ~$828k portfolio.

Year 15: ~$26k/yr; ~$1.5M portfolio.

Year 20: ~$44k/yr; ~$2.6M portfolio.

Year 35: ~$200k/yr; ~$15.1M portfolio.

Top Lesson (17:15)

Start early, live below your means, and reinvest.

You can begin with simple ETFs and learn as you go.

Use the right tools to stay consistent and improve decisions.

Launch Your Amazon Product to $100K+ in Revenue—Fast!

Want to quickly scale your new Amazon product launches into listings earning over $100K annually—in less than two months? Stack Influence makes it easy by automating thousands of micro-influencer collaborations each month. Say goodbye to complicated outreach, negotiating influencer fees, and managing complex campaigns. With Stack Influence, influencers are paid only in your products, creating authentic user-generated content (UGC) that drives real engagement and boosts your organic Amazon rankings.

Leading brands like Magic Spoon, Unilever, and MaryRuth Organics already rely on Stack Influence to achieve impressive sales growth, enhance brand visibility, and build genuine connections with customers. Fully automated management means effortless campaigns, giving you complete control without lifting a finger. Boost your listings, increase external traffic, and own full rights to impactful influencer-generated images and videos.

Experience rapid, stress-free growth and proven results with micro-influencer marketing.

Dividend News

🚀 Dividend Raises This Week

Track your dividends and get breaking news on increases, decreases, and special dividends with DividendData.com.

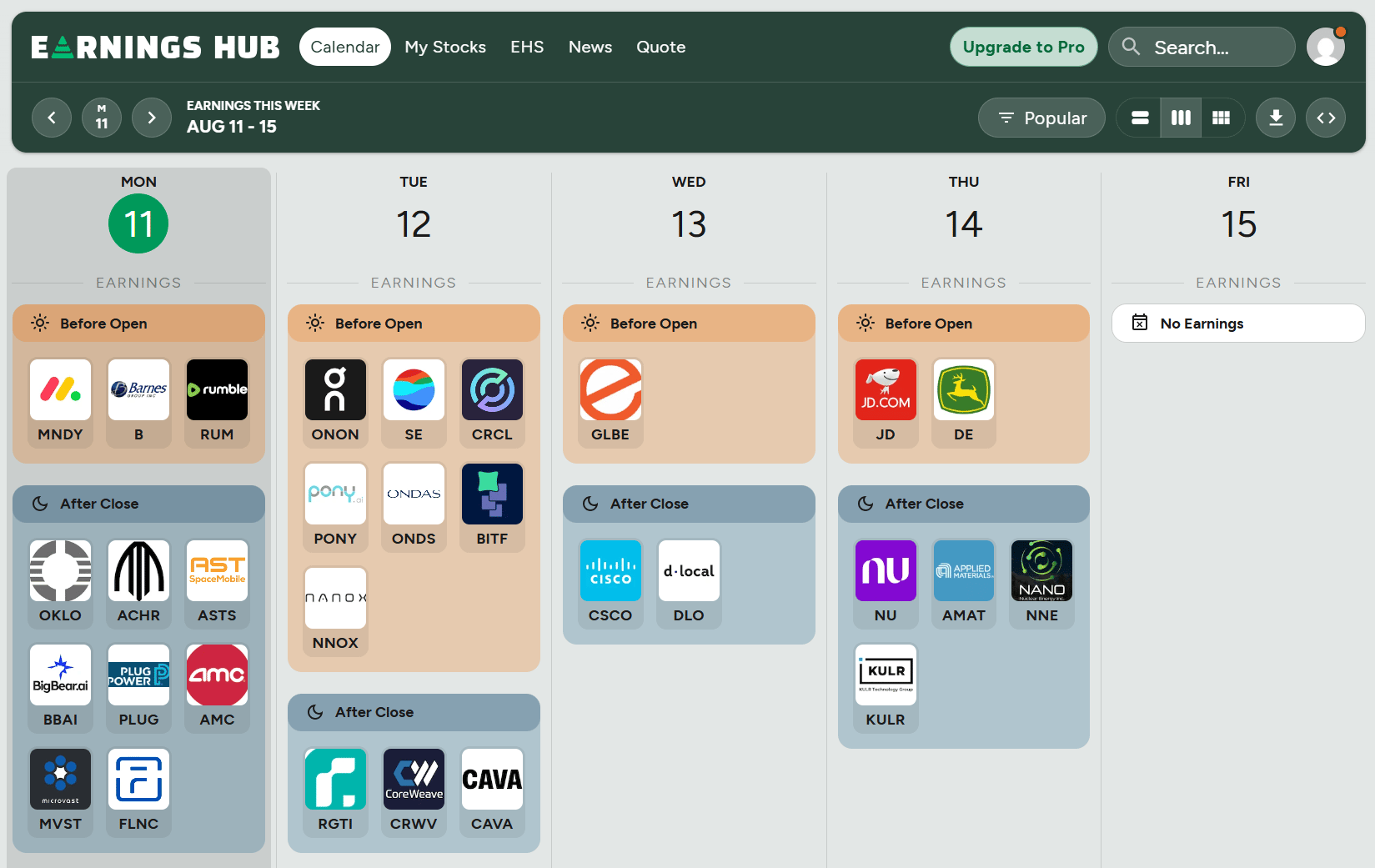

📰 Earnings This Week

P.S. Our official partner for Earnings news is Earnings Hub. Create an account so they know we sent you.

💰 My Buys This Week

Bought more midstream stocks today and will keep adding below these prices.

- Bought 3 shares of $HESM at $41.86

- Bought 3 shares of $MPLX at $51.62— Dividend Data (@dividend_data)

9:57 PM • Aug 5, 2025

Bought 2 more shares of $TPL today at an average cost of $891.14

— Dividend Data (@dividend_data)

8:42 PM • Aug 7, 2025

Bought 11 more shares of $MPLX today at $50.42

— Dividend Data (@dividend_data)

8:33 PM • Aug 8, 2025

How did you like today’s newsletter? |

📅 Keep Investing. Stay informed.

– Zach

Founder, Dividend Data

P.S. Questions or suggestions? Reply to this email—I'd love your feedback!

Follow on YouTube | Listen on Spotify | Visit DividendData.com

Disclaimer: Dividend Dividend (Dividend Data LLC) is not a professional financial service. All materials released from Dividend Data (Dividend Data LLC) are for educational and entertainment purposes. Dividend Data (Dividend Data LLC) is not a replacement for a professional's opinion. Contributors to the Dividend Data (Dividend Data LLC) might have equities mentioned in the newsletter