- Dividend Data

- Posts

- Can NVDA Keep Making New Highs? - Nvidia Stock Analysis

Can NVDA Keep Making New Highs? - Nvidia Stock Analysis

Hey, Zach here!

Happy Labor Day! I hope you had a great weekend and are ready for a week of successful investing. Speaking of work, I have a great deep dive into a leading AI company that may help put us out of work for good! JK.

Today’s topics:

Fantasy Football Draft Tonight!

New Nvidia Stock Analysis

Earnings This Week

Big Dividend Raise!

Fun Update! Fantasy Football Draft is Tonight!

September 1st at 7pm EST. Look forward to seeing you there.

The Key Story

Can NVDA Keep Making New Highs? - Nvidia Stock Analysis

Why NVDA matters (macro impact)

Nvidia is now the world’s most valuable company ($4.4T+ market cap).

Q2 earnings just dropped; stock fell ~2.5% after hours.

NVDA drives the whole market: it’s ~8% of the S&P 500 and 10%+ of QQQ—even passive investors are exposed.

Who’s funding NVDA’s growth

NVDA’s revenue is effectively Big Tech’s AI capex (Azure, AWS, Meta, Google).

CEO said top four hyperscalers doubled capex in 2 years to a $600B+ annual run rate toward AI infra—a large share flows to NVDA.

The core questions

Will hyperscalers keep increasing AI spend?

Will the ROI justify that spend or get throttled?

These dynamics likely drive the market for years.

Q2 snapshot (why the post-print dip?)

Revenue: $46.7B (+6% QoQ, +56% YoY).

Data Center = 88% of total; up 5 pts QoQ.

Blackwell next-gen platform grew 17% sequentially (key multi-year driver).

Model, margins, and money machine

Gross margin ~72%.

Fabless model (design + sell; outsource manufacturing to TSMC) supports premium margins.

TTM capex ≈ $4B vs TTM FCF ≈ $72B → extreme cash generation.

Guidance & near-term outlook

FY2026 Q3 revenue guide: ~$54B (±2%); gross margin ~73%.

Latest quarterly EPS ≈ $14 (all-time high).

Street projects FY2026 EPS growth ~49.5% to $441 annual EPS (≈ 41.1× P/E at today’s price).

FY2027 EPS growth est. ~36%; visibility fades further out.

Growth track record (per-share)

Revenue/Share 5-yr CAGR: ~63.98%.

Net Income/Share 5-yr CAGR: ~91.6%.

FCF/Share 5-yr CAGR: ~69.8%; 3-yr ~96.67%; FY24→FY25 +126.4%.

Balance sheet strength

Cash & ST investments: ~$52.6B.

Net debt: ~–$42.4B (net cash).

Equity at all-time highs; financial position strengthening.

Key risk to monitor

NVDA is tied to hyperscaler capex cycles. If Big Tech front-loaded spend or slows to wait for AI demand, growth could decelerate.

My stance

I’m structurally bullish on AI over multi-decades and see continued reinvestment from cloud leaders (MSFT is my largest holding).

For long-term holders: I’d keep riding this high-quality compounder.

For traders: I’d wait for explicit signs of capex cuts from MSFT/AMZN/META/GOOGL—likely the tell that the NVDA bull run is tiring.

Even post-cycle, NVDA could still generate tens (maybe hundreds) of billions in FCF annually.

Tools I used

All charts/metrics pulled with DividendData.com (now covers 80,000+ tickers incl. ETFs, mutual funds, international).

A Brief Word From Our Sponsor…

The easiest way to hire globally

Don’t let borders limit your hiring strategy. RemoFirst gives you one platform to legally employ talent around the world—compliantly, affordably, and fast.

We support EOR and contractor payments in 185+ countries with no annual contracts, flat pricing, and full transparency.

Whether you’re a startup or scaling enterprise, you’ll get hands-on support and built-in tools for international payroll, health benefits, taxes, and more.

RemoFirst offers a free tier for contractor management, and EOR fees start at $199/month.

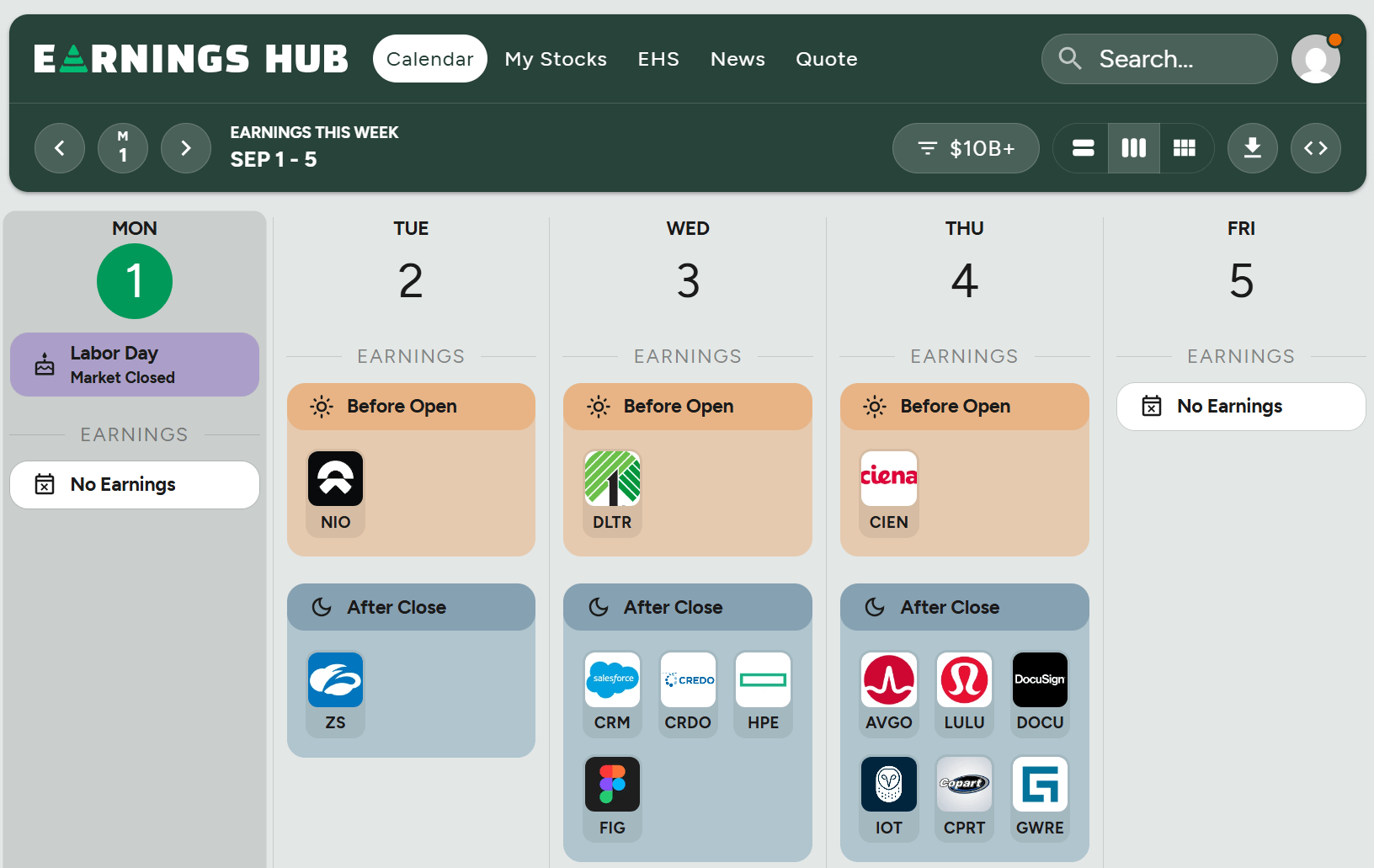

Earnings News

Salesforce (CRM) & Broadcom (AVGO) report this week as earnings season wraps up

P.S. Our official partner for Earnings news is Earnings Hub. Create an account so they know we sent you.

Dividend News

My Top High Yield Dividend Stock Just Raised it’s Dividend, Again!

$MO - Altria Group increases quarterly dividend by 3.9% to $1.06 per share versus the previous rate of $1.02 per share.

This increase marks the 60th dividend increase in the past 56 years.

— Dividend Data (@dividend_data)

3:24 PM • Aug 22, 2025

Track your dividends and get breaking news on increases, decreases, and special dividends with DividendData.com.

How did you like today’s newsletter? |

📅 Keep Investing. Stay informed.

– Zach

Founder, Dividend Data

P.S. Questions or suggestions? Reply to this email—I'd love your feedback!

Follow on YouTube | Listen on Spotify | Visit DividendData.com

Disclaimer: Dividend Dividend (Dividend Data LLC) is not a professional financial service. All materials released from Dividend Data (Dividend Data LLC) are for educational and entertainment purposes. Dividend Data (Dividend Data LLC) is not a replacement for a professional's opinion. Contributors to the Dividend Data (Dividend Data LLC) might have equities mentioned in the newsletter