- Dividend Data

- Posts

- 3 Dividend Stocks I'm Buying Now

3 Dividend Stocks I'm Buying Now

Happy Monday,

It’s Zach here with another weekly investing update for you!

New year, same strategy. I’m still buying high quality cash flowing businesses that continually pay growing dividends.

Today, I’m going to share 3 dividend stocks that I bought this week. Plus, some huge news that may send Visa & Mastercard stock down this week.

The Key Story

3 Dividend Stocks I'm Buying Now

Hess Midstream (HESM)

30 shares of $HESM at $33.51

Annual Dividend (FWD) | Dividend Yield | Total Income |

$3.02 | 9.01% | $90.58 |

HESM is a dividend growth machine, raising it’s payment every quarter. If you’ve been following me, then you know this has become a top position of mine.

I’ll likely do an updated full stock analysis video soon.

Due to recent sells offs, the dividend yield is the highest of the past 5 years.

Prompt: “HESM Dividend Yield“, AI Analyst - DividendData.com

MPLX LP (MPLX)

22 shares of $MPLX at $52.63

Annual Dividend (FWD) | Dividend Yield | Total Income |

$4.31 | 8.18% | $94.73 |

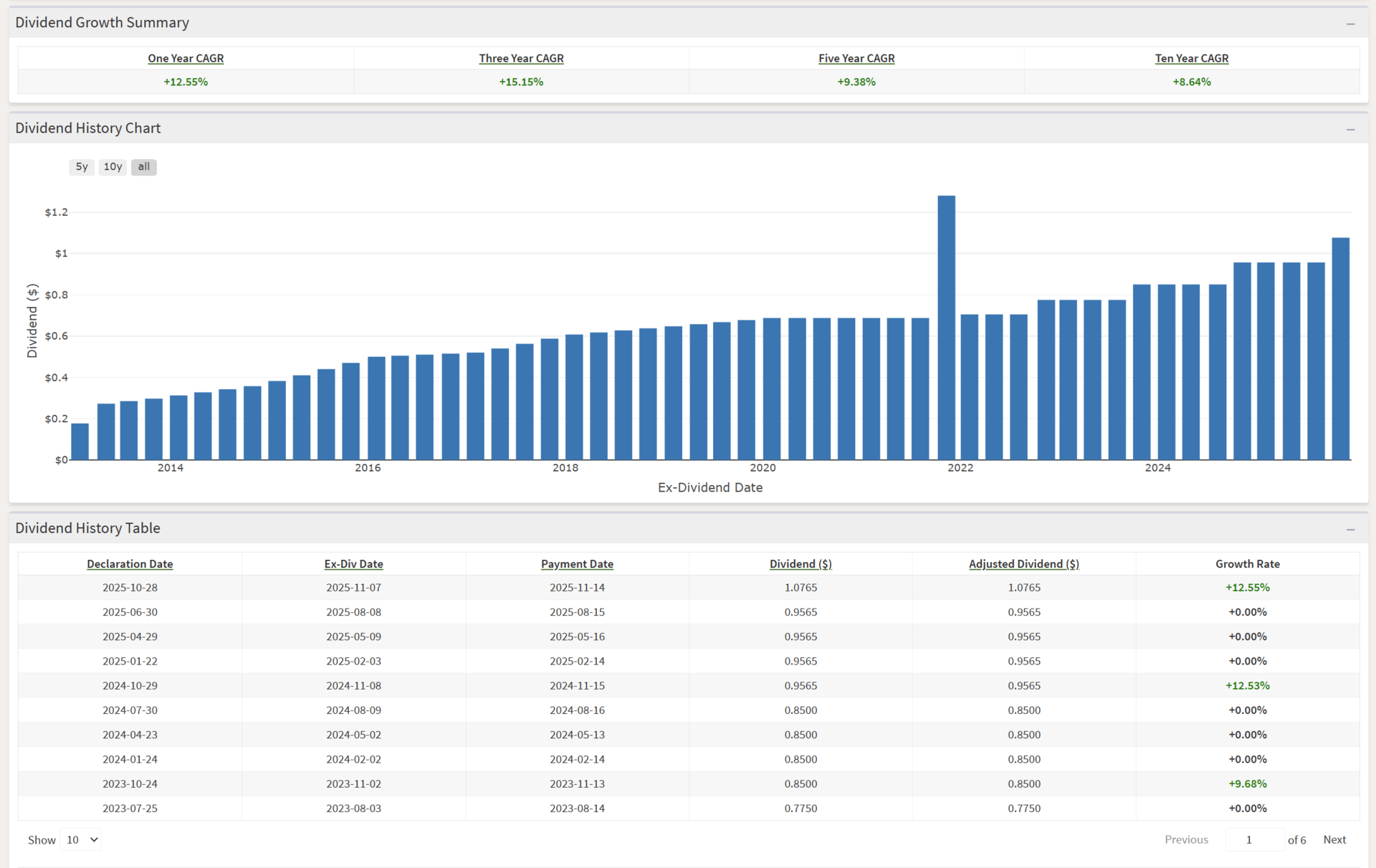

This is another midstream oil & gas company, which has reliable dividend growth. The latest increase was 12.5% and the 5 year CAGR is 9.38%.

Both HESM and MPLX have a rare combination of high yield and high growth.

Microsoft (MSFT)

1 share of $MSFT at $472.60

Annual Dividend (FWD) | Dividend Yield | Total Income |

$3.64 | 0.77% | $3.64 |

Why I keep buying Microsoft? Well, the company keeps growing. It’s a compounding machine. Earnings are expected to continue growing quarter after quarter.

MSFT Earnings Per Share, Source: DividendData.com

I should do updated stock analysis videos on all these soon!

Reply to this email if you want me to a deep dive.

Bonus: I Got Paid a $500 Dividend

News I’m Watching

Trump Pushes Credit Card Interest Rate Cap - Will Visa and Mastercard Sell Off?

Why am I following this?

Well, I don’t care much about the actual policy, but the implications of what it could be to Mastercard (MA) and Visa (V) stock this week.

I will be watching for a potential sell off, which I’ll view as a buying opportunity.

Why? Most people don’t understand how these companies make money.

Visa and Mastercard operate payment networks that verifies payments and prevents fraud (among much more). They don’t issue cards themselves. They don’t directly make money from interest or bear credit risk. They operate the network. Want to learn more? Read the latest Visa quarterly report.

That said, the news could be a short term pressure to their financial institution partners who do issue the cards. They’ll still make a ton from interchange fees, but might be more selective with credit access.

Dividend News

🚀 Dividend Raises This Month

EPD - Enterprise Products Partners raises dividend by 0.9%

RPRX - Royalty Pharma raises quarterly dividend by 6.8% to $0.235/share

OTTR - Otter Tail raises dividend by 10%

SNX - TD SYNNEX raises dividend by 9.1% to $0.48

MMS - MAXIMUS raises quarterly dividend by 10% to $0.33/share

ALG - Alamo raises quarterly dividend by 13.3% to $0.34/share

OZK - Bank OZK raises quarterly dividend by 2.2% to $0.46/share

EME - EMCOR raises quarterly dividend by 60% to $0.40/share

How did you like today’s newsletter? |

That’s it for this week’s update. If you want to follow along in real time, analyze these tickers, or track your own portfolio, jump into DividendData.com. You’ll also find our Discord community and my AI research tool there. Hit reply and tell me what you’re buying—I may feature a few notes next week.

📅 Keep Investing. Stay informed.

– Zach

Founder, Dividend Data

P.S. Questions or suggestions? Reply to this email—I'd love your feedback!

Follow on YouTube | Listen on Spotify | Visit DividendData.com

Disclaimer: Dividend Dividend (Dividend Data LLC) is not a professional financial service. All materials released from Dividend Data (Dividend Data LLC) are for educational and entertainment purposes. Dividend Data (Dividend Data LLC) is not a replacement for a professional's opinion. Contributors to the Dividend Data (Dividend Data LLC) might have equities mentioned in the newsletter