- Dividend Data

- Posts

- 2 Cheap Dividend Stocks I'm Buying Now

2 Cheap Dividend Stocks I'm Buying Now

In partnership with

Hey, Zach here!

Today, I’m going to share 2 cheap dividend stocks I’m buying now. Plus, I’ll share a full update on my $241k dividend growth stock portfolio. On top of that, I’ll provide new dividend increases and top stock who are reporting earnings soon.

Today’s topics:

Earnings This Week (Google!)

Dividend Increases This Week

2 Cheap Dividend Stocks I'm Buying Now

My New Buys

Earnings News

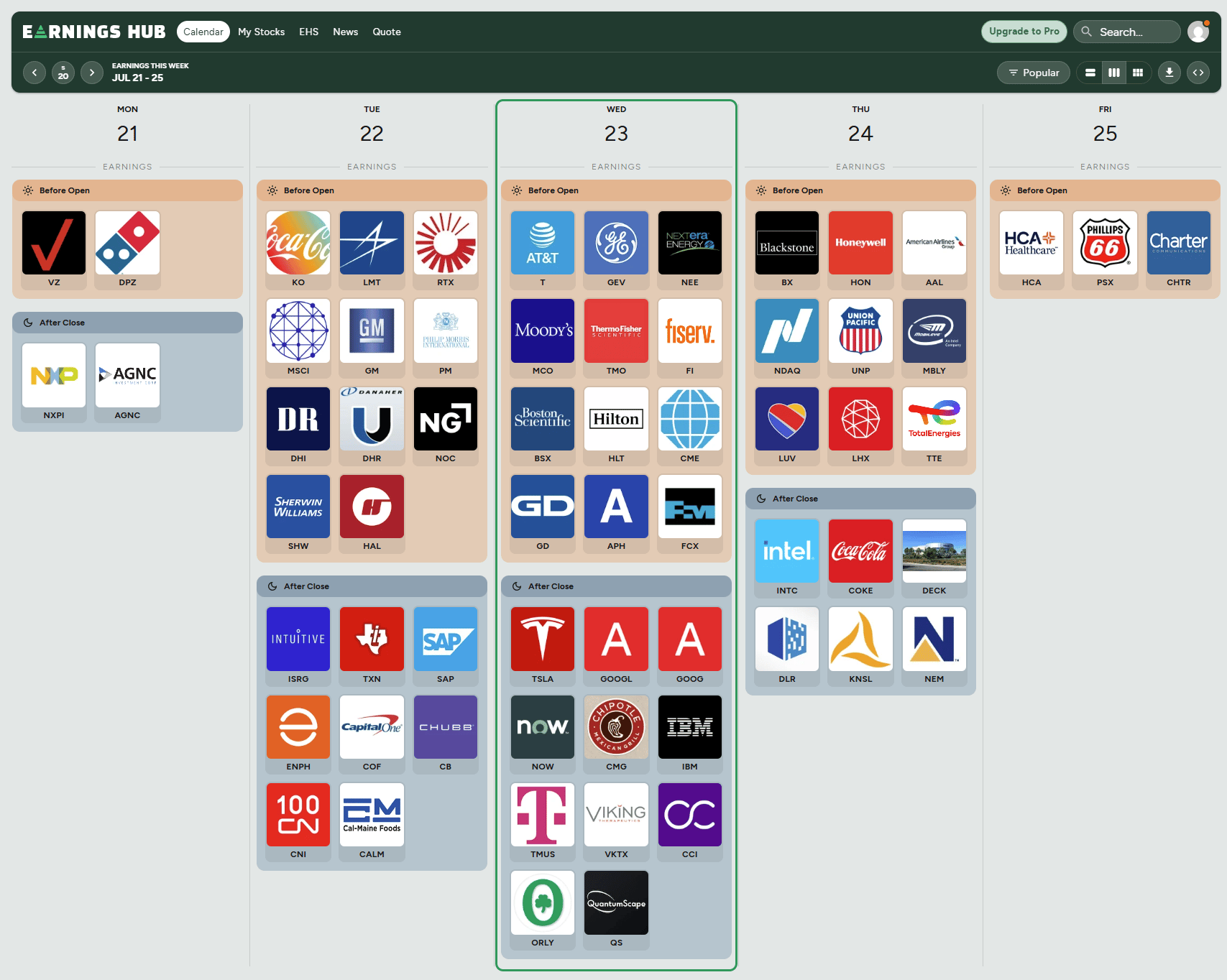

Earnings Season is Ramping Up! Alphabet (Google) This Week!

Wednesday is a big day for me with Google reporting. Plus, Tesla for you growth investors! Here’s the list:

Monday (07/21):

VZ - Verizon Communications Inc.

DPZ - Domino's Pizza, Inc.

Tuesday (07/22):

KO - The Coca-Cola Company

LMT - Lockheed Martin Corporation

RTX - RTX Corporation

MSCI - MSCI Inc.

GM - General Motors Company

PM - Philip Morris International Inc.

TXN - Texas Instruments Incorporated

Wednesday (07/23):

T - AT&T Inc.

NEE - NextEra Energy, Inc.

MCO - Moody's Corporation

TSLA - Tesla, Inc.

GOOGL - Alphabet Inc.

NOW - ServiceNow, Inc.

CMG - Chipotle Mexican Grill, Inc.

IBM - International Business Machines Corporation

TMUS - T-Mobile US, Inc.

Thursday (07/24):

BX - Blackstone Inc.

HON - Honeywell International Inc.

NDAQ - Nasdaq, Inc.

UNP - Union Pacific Corporation

LUV - Southwest Airlines Co.

INTC - Intel Corporation

COKE - Coca-Cola Consolidated, Inc.

Friday (07/25):

PSX - American Express Company

P.S. Our official partner for Earnings news is Earnings Hub. Create an account so they know we sent you.

Dividend News

🚀 Dividend Raises This Week

Top Dividend stocks like CMI, DUK, UNP, SJM, and STT report raised their dividend payments last week.

SPFI - South Plains Financial raises quarterly dividend by 7% to $0.16/share

CBU - Community Financial System raises quarterly dividend by 2.2% to $0.47/share

RF - Regions Financial raises quarterly dividend by 6% to $0.265/share

SJM - J. M. Smucker raises quarterly dividend by 1.9% to $1.10/share

STT - State Street raises quarterly dividend by 10.5% to $0.84/share

UNP - Union Pacific raises quarterly dividend by 3% to $1.38/share

GCBC - Greene County Bancorp raises dividend by 11.1% to $0.10

Track your dividends and get breaking news on increases, decreases, and special dividends with DividendData.com.

The Key Story

2 Cheap Dividend Stocks I'm Buying Now

This week I added two high‑yield, cheap‑valued midstream energy names to my dividend growth portfolio. Both combine attractive yields with strong dividend growth and reliable cash flows.

MPLX (MPLX)

Bought 19 shares at $50.45 in July.

Yield on cost: 7.59%. Current yield: 7.53%.

Dividend growth: 10‑year CAGR of 8.8%; 3‑year CAGR of 10.7%.

Last dividend increase was 12.5%.

Structured as a partnership—focus on distributable cash flow for true dividend sustainability.

Why I like it: High yield, double‑digit dividend growth, and trades at a cheap valuation.

Hess Midstream (HESM)

Bought 16 shares at $37.82 in July.

Yield on cost: 7.51%. Current yield: 6.92%.

Dividend growth: 5‑year CAGR of 10.5%; raises its dividend every quarter.

Recent news: Chevron’s acquisition of Hess makes Chevron the largest owner of HESM and adds financial backing behind long‑term contracts.

Why I like it: Rare blend of high yield and high growth, plus extra stability from Chevron’s ownership.

These two buys push my projected annual income higher and beef up my traditionally light summer months. Both names offer a “snowball effect” as dividends get reinvested and payouts continue to grow.

Watch on YouTube: https://youtu.be/VcPrvTuC2uk

Listen on Spotify: https://open.spotify.com/episode/1YYknz6SWH9Matw69KbH2o?si=FHNG7YOvSp-ym8TP5qxY8A

💰 My Buys This Week

Bought 3 more shares of $HESM at $37.95

— Dividend Data (@dividend_data)

8:30 PM • Jul 16, 2025

Bought 3 more shares of $MPLX at $50.13

— Dividend Data (@dividend_data)

8:05 PM • Jul 15, 2025

How did you like today’s newsletter? |

📅 Keep Investing. Stay informed.

– Zach

Founder, Dividend Data

P.S. Questions or suggestions? Reply to this email—I'd love your feedback!

Follow on YouTube | Listen on Spotify | Visit DividendData.com

Disclaimer: Dividend Dividend (Dividend Data LLC) is not a professional financial service. All materials released from Dividend Data (Dividend Data LLC) are for educational and entertainment purposes. Dividend Data (Dividend Data LLC) is not a replacement for a professional's opinion. Contributors to the Dividend Data (Dividend Data LLC) might have equities mentioned in the newsletter